Government calls for partnerships in policy formulation

Mombasa, Thursday, May 25, 2023

KNA by Fatma Said

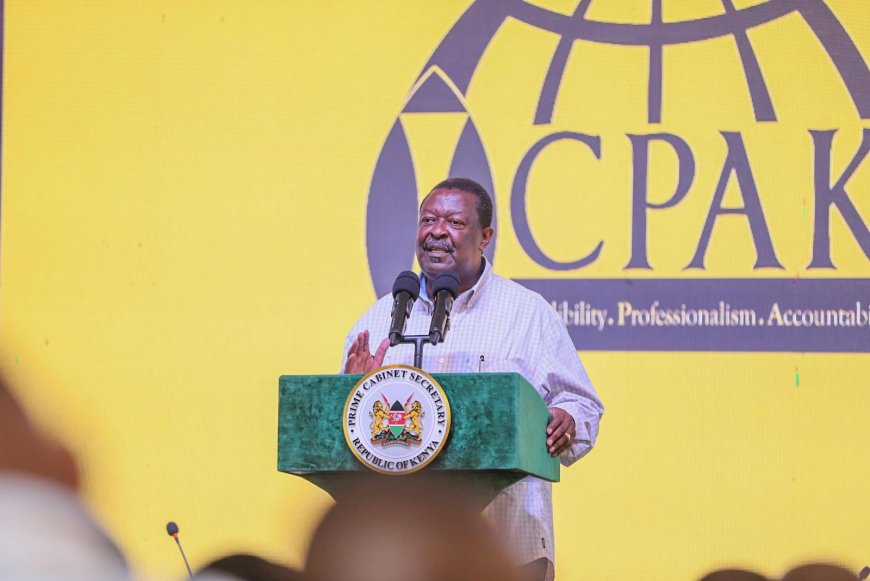

Prime Cabinet Secretary Musalia Mudavadi has urged Accountants and other professions to partner with the government in policy formulation and implementation, so as to collectively contribute in spurring the economic growth of the country.

Mudavadi has also assured citizens that the measures being taken by the government to turn around the economy, may be painful but were credible.

Mudavadi urged Kenyans to bear with tax base expansion measures being made, such as reinstatement of 16 percent VAT on petroleum products, that will net Sh70 billion in additional revenue.

Subsidies on fuel were costing the government between Sh16 billion to Sh20 billion every month, hence the Prime Cabinet Secretary said the cost is not sustainable, as the government is focusing on tax base expansion, minimizing wastage, and prudent management of public resources.

The Finance Bill 2023 is seeking to reverse a decision made in 2018, where VAT on fuel was reduced from 16 percent to 8 percent, a proposal that Mudavadi said is necessary to support economic recovery.

Speaking at the 40th Institute of Certified Public Accountants, Kenya (ICPAK) Annual Seminar, Mudavadi said the government is digitizing public procurement procedures among others to tame corruption.

He acknowledged that the theme for this year’s Annual Seminar, “Leading from the Front: Accounting Profession as a Catalyst for Economic Growth” could not have come at a better time.

“Our country’s determination is to transform lives under the Bottom-Up Economic Transformation Agenda, popularly known as BeTA,” he said.

Mudavadi said that the Government expects more from accountants’ role to facilitate Open-Government.

The prime cabinet secretary conveyed commitment and extended a hand of partnership with ICPAK, with a caveat that the Institute intensifies high quality corporate reporting that it is important in cultivating transparency and protecting public resources.

This, he said, will help financial stability, facilitate the mobilization of domestic and international investment; and fashion a conducive business and investment.

He assured that the Government’s intervention instrument is to alleviate suffering, but the Finance Bill has attracted heated discussion.

Mudavadi highlighted some of the measures the government is putting in place to spur the economy in the Finance Bill.

“The Government has shifted its subsidy policy from consumption to production, through the Finance Bill, 2023 and proposes to provide exemptions under the VAT Act for fertilizers and inputs or raw materials, locally purchased or imported by manufacturers of fertilizers,” he said.

He elaborated that this shall lower the cost of fertilizer, which will in turn lower the cost of production for farmers.

Furthermore, Agricultural pest control products, raw materials for manufacture of fertilizers and transport of sugar cane to millers, have been VAT exempted.

This intervention aims to promote agriculture and enhance food security.T

The Government, through the Finance Bill, has allowed for the zero-rating of supply of maize, cassava, wheat or muslin and maize flour containing cassava flour, under the VAT Act, which will allow Kenyans to access Unga at affordable prices.

To spur manufacturing, the Government is proposing reduction of Import Declaration Fee (IDF), from 3.5 percent to 2.5 percent and has removed the 1.5 percent IDF rate for Affordable Housing.

It has also introduced Export and Investment Promotion Levy, to boost local manufacturing and in equal measure, the Railway Development Levy (RDL), is proposed to move down from 2.5 percent to 1.5 percent.

Further, an Original Equipment Manufacturer (OEM) operating in Kenya, will enjoy 15 percent Corporate Income Tax on parts designed and manufactured in Kenya.

This will allow local manufacturing of genuine parts that will increase lifespan of vehicles and machines.

Mudavadi urged the public servants to stick to professionalism, transparency and accountability.

ICPAK Chairman, George Mokua, asked accountants to continue upholding integrity, as they execute public financial matters within different sectors.

Mokua said Kenya's private and public sector needs to take core advantage of accountants to build their portfolios in different sectors.

Courtesy ; K. N. A

What's Your Reaction?