Market trends and investment opportunities in the global market outlook

Nairobi, Monday July 3, 2023

KNA by Susan Gichanja/ Lucy Gitei

Standard Chartered Bank today held a media briefing session to discuss the global market outlook that is aimed at explaining the current economic effects on Kenyan businesses and their impact on Kenyans.

Africa, Middle East and Eastern Europe (AMEE), Chief Investment Officer Standard Chartered Bank Global Manpreet Gill Singh advised investors to focus on a strategy themed 'Keep CALM'.

Singh said that high quality bonds continue to offer extremely attractive yields and longer tenure quality bonds offer potentially better returns compared to cash as they approach the end of a hiking cycle whereas growth assets are more volatile than income assets and are a valuable source of long-term returns.

“Standard Chartered continues to offer market forecasts on the economic outlook to offer individuals an edge in investments and diversification of portfolio as they navigate through these dynamic times," he said.

"In one of its recent reports, it alluded that equities are expected to outperform bonds over the long run. Its however noted that this will have interesting implications for investors. It means that it is highly likely that an income-focused investment strategy – given the high allocation to bonds – will significantly underperform a growth-oriented strategy with its greater exposure to equities,” he added.

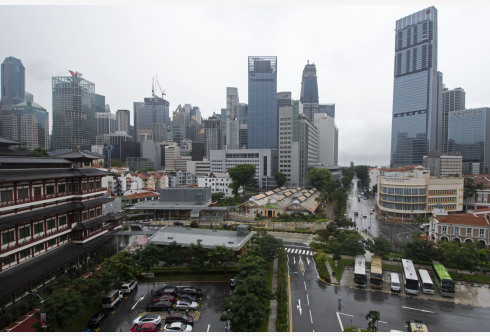

Speaking about the investment opportunities, the Head of Affluent Banking and Wealth Management, Standard Chartered Kenya and East Africa Paul Njoki said Africa remains an exciting investment destination with positive demographics, rising adoption of technology and rising consumer and business spending.

“With Africa set to account for 25 per cent of the global population by 2050 – and with robust growth in key sectors, the continent offers an attractive investment proposition for international capital,” he explained.

Njoki said, “Over the recent years we have witnessed most of the investment being concentrated in high-growth sectors such as tech and green energy as increasingly impact-oriented investors look for sustainable solutions to the various challenges like the climate crisis. In 2020, over half of all PE investments in the region were in the tech sector while African start-ups raised over $1 billion for the first time in 2021.”

He further stated, “Despite the various impediments, realignments in global supply chains could present some opportunities for Kenya and the continent as Western economies seek new sources of energy and commodities. However, Africa will only be in a position to take advantage of these shifts and drive forward social and economic development if FDI flows level out. This means both leveraging private capital for investments in Africa’s high-growth sectors and supporting structural reforms to improve the investment climate across the region.”

Courtesy ; K. N. A

What's Your Reaction?