My sh. 3 million Youth Funded centure turned into ashes, a woman narrates painful ordeal

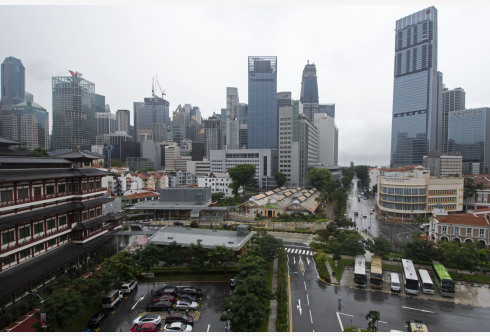

Naivasha, Wednesday, May 17, 2023

KNA by Erastus Gichohi

Damaris Muthoni,35, is a woman living in distress. She is yet to come to terms with the unfortunate events of February 24, 2021, when a fierce fire razed down her successful agri-business properties.

Muthoni started her entrepreneurial journey in 2014 in Naivasha town where she ventured into the gas supply business. It was a smooth ride to success as her business flourished, and her sales soared.

Within two years into the business, she had managed to employ four permanent workers at her shop to cater for the growing list of customers seeking her services.

Muthoni had bigger dreams of expanding her successful business. In 2017, a friend referred her to the Youth Enterprise Fund for interest-friendly loans to cater for her business expansion.

She didn’t hesitate. She applied for Sh.1.5 million which she was to pay back within five years with an additional interest of 8 percent. She channeled the amount into her booming business transitioning to a well-grounded wholesaler in the lakeside town.

Muthoni says in a good day, she fetched a profit of sh. 15,000 selling up to 100 gas cylinders. This was remarkable, she said, backed by government incentives for Kenyans to use clean energy sources.

Muthoni did not only clear the loan as agreed but she did so within a record 18 months. Her business acumen had paid off, she said.

She cast her net wide. In 2020, Muthoni turned to the Youth Fund and applied for a new loan of sh. 3 million to enable her to venture into agribusiness and diversify her earnings.

The mother of two says that the decision to diversify her income was informed by the disruptions brought forward by the Covid 19 pandemic in the country. Her business was hit hard as customers’ fortunes dwindled. Her sales plummeted.

To actualize her new venture, she rent out a quarter-acre piece of land in the Kayole area of Naivasha where she established successful dairy farming, pig rearing, poultry, and a biogas plant to boot.

“I had eight dairy cows, 60 pigs, and over 100 kienyeji chickens within a few months of establishment and the future looked bright," she said.

This new venture, Muthoni said, cushioned her from the Covid pandemic shocks that had affected many businesses across the country. Within months, the new venture earned her a profit of over sh.250,000 which enabled her to start paying off her loan.

A new biogas plant was in the offing. She contracted 10 of her neighbors where she was to supply piped biogas to their homes at a monthly fee of sh. 3,000.

Muthoni entrepreneurial skills and hard work had paid off. Visitors and soon-to-be farmers started trooping to her home to learn her magic. She too started giving talks on agribusiness.

Youth fund officials at one time visited her to record the success story of how the government kitty can help young people earn a decent living. Muthoni's success story was shared with admiration.

But on the turn of events and unknown to her, the devil lay in wait. On the morning of February 24, 2021, a fierce fire broke out at her business premise as efforts to salvage the situation bore little fruit. All hell broke loose.

Muthoni says although some of the livestock were saved, they soon died from suffocation. She recalls the occurrences of the tragic day with a pinch of salt. She read malice on the cause of the incident.

She, unfortunately, had not insured her business against such a fatal misfortune. A mistake that wiped out her years of investments.

It’s been two years since she reported the matter to the police and samples collected for further investigations. She lost count of the many times she visited the Naivasha police station to follow up on the matter. She let bygone be bygones.

“All my hard-earned investments turned into ashes, my friends and business associates took off as I came to terms with the huge financial losses,” Muthoni said as tears welled down her cheeks.

Muthoni turned on her gas business profits to clear the accruing arrears which she was to pay a sum of sh.65,000 per month. She managed only to clear sh. 500,000 and couldn’t afford a penny more to top up.

A few months after failing to remit her monthly deductions, the Youth fund is on her neck as it rolls its sleeves to recoup its money. The agency auction hammer already eyeing her inherited plot in the Syokimau area in Nairobi which she had placed as security for the loan.

Muthoni is pleading with the fund officials to give her an extended moratorium on her payments as well as halt accruing interests on the loan to enable her to make plans to clear her dues on flexible terms.

"The fund is seeking to recoup over sh. 3 million that I had been loaned but unfortunately I am stuck as all my investments crumbled before my eyes," said Muthoni.

Muthoni regrets that the loan which had positively turned around her fortunes have now become a curse, eating her soul and thoughts away.

She is currently seeking medical attention as she battles depression even as she comes to terms with what befell her once luminous life. Last year, Muthoni had a miscarriage, a painful experience her memory can't let go of.

“I have knocked on many doors seeking help but none seems forthcoming”, she says adding my husband and my two boys are my only remaining source of strength.”

Courtesy; K.N.A

What's Your Reaction?