Bank promises to support farmers in afforestation activities

Murang’a, Sunday, April 16, 2023

K.N.A By Bernard Munyao

National Commercial Bank of Africa (NCBA) group has promised to continue engaging and supporting farmers in their efforts of increasing tree and forest cover.

The bank’s Managing Director (MD) John Gachora has noted that afforestation will help in mitigation of negative impact of climate change thus supporting farming activities.

Mr Gachora divulged that since last year, NCBA has supported planting of more than 11, 000 tree seedlings in parts of Nyeri county saying the exercise will be rolled out in others parts of the country.

He observed that as the bank continues opening new branches in counties, the exercise will go hand in hand with planting of trees stating that the bank also has some programmes aimed at supporting farming to increase food production.

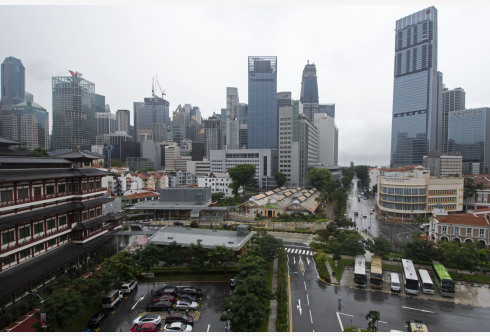

The MD spoke in Murang’a during the opening of two bank branches in Kenol and Murang’a town on Friday.

“Our bank will endeavor in supporting the government's directive on planting of trees. NCBA will engage farmers to grow trees as a way to mitigate effects of climate change. With ongoing rains, the bank will donate seedlings to various groups,” he said.

The MD further called on farmers and business community to take advantage of credit facilities provided by various financial institutions to grow their investments.

“Farmers, those in business should not shy away from sourcing financing from banks among other financial institutions. People should get information from banks on how they can access cheap credit facilities,” stated Gachora.

The MD noted that NCBA has been on a branch expansion exercise since 2021 and plans to open an additional 10 branches in 2023 are underway.

He noted that the opening of the two bank branches in Murang’a will take services closer to customers who are mainly engaged in agricultural activities.

Murang’a County Executive Committee ((CEC) member for trade and industry Paul Mugo who was present said the county administration is working on various incentives to woo investors in Murang’a.

Mugo noted that the presence of numerous financial institutions in the county will enable business people and farmers to access cheap and competitive credit facilities.

The CECM noted that Murang’a being an agricultural county, there is need to bring in investors to establish agro-industries to carry out value addition of locally produced farm produce.

“Farm produce from this county is sold raw. Our aim as county government is to ensure there are locally established industries to do value addition of the produce. This will not only increase farmers' returns but create employment to scores of young people,” he added.

Mugo challenged local financial institutions to come up with programmes aimed at supporting farmers to increase productivity.

“It is my belief that the opening of this NCBA branch will allow farmers to access financing with ease, and will allow the people of Murang’a to inject funds into mechanising their farming activities.” Added the CECM.

Courtesy K.N.A

What's Your Reaction?