Banking industry makes Sh181 billion tax contribution

By Peter Ochieng

Kenya's banking industry made a significant improvement in tax contribution, between 2021 and 2022.

According to report of the 2022 Total Tax Contribution (TTC), the banking industry made a total tax contribution of Sh181.27 billion in 2022, marking an increase of 39.94% from Sh129.52 billion in 2022.

This means the 2022 contribution is 8.93% of the total government tax receipts in Kenya, compared to 6.8% in 2021.

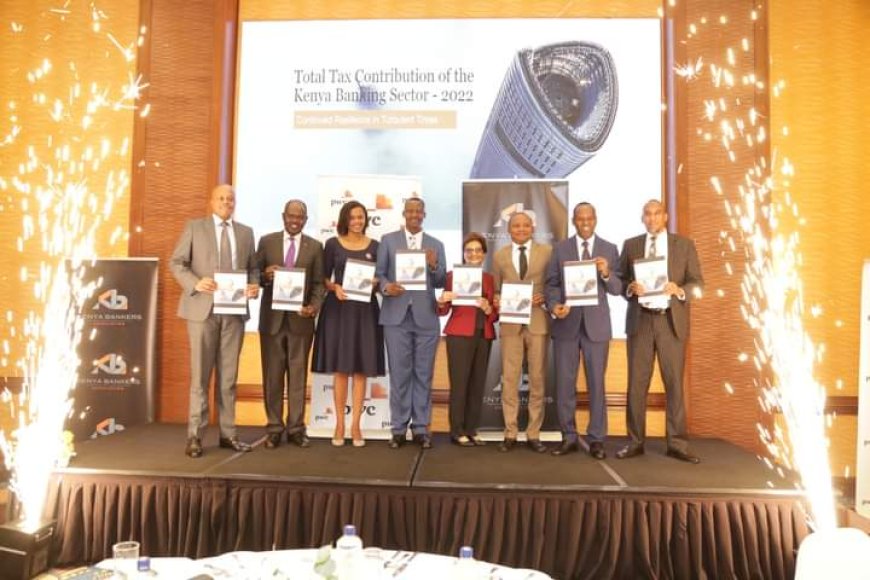

The TTC study was produced by PwC Kenya, on behalf of the Kenya Bankers Association (KBA).

The report is based on an analysis of tax payments of 39 banks who participated in the study, representing 97.65% of the market share.

Speaking during the event, KBA CEO Habil Olaka said the financial services sector plays an important role, in supporting economic growth.

He said the banking industry remains committed to sustain efforts towards anchoring business growth, despite geopolitical challenges and various adverse effects both in the global and domestic macroeconomic environment.

“This report continues to demonstrate high levels of transparency and compliance among banks, which highlights sound corporate governance. There is no doubt that the TCC also underlines the industry’s collective commitment to transparency and tax compliance. As an industry we are, therefore, happy that our members are at the forefront of tax transparency and compliance in the corporate sector.”

Peter Ngahu, PwC Kenya’s Country Senior Partner and Regional Senior Partner, Eastern Africa, in his part said the report provides valuable insight into how the Total Tax Contribution of the banks grew by 39.94% in 2022 relative to 2021.

What's Your Reaction?