Credit facility that will benefit SMEs launched in Nakuru

Nakuru, Thursday, May 18, 2023

KNA By Jane Ngugi

Church-backed Caritas Microfinance Bank (Caritas MFB) has opened its 8th branch in Nakuru County, targeting small businesses and individuals requiring working capital, but unable to get the same from banks.

The microfinance institution said its entry into Nakuru would continue lending to businesses mainstream banks consider risky and thus deny credit.

Caritas Microfinance Bank Chief Executive Officer Mr David Mukaru noted that Small and Medium-sized Enterprises (SMEs) are the drivers of Kenya’s economy, yet they have been starved of credit in the country.

The Microfinance Bank, whose key shareholders are various institutions in the Catholic Church, was granted a nationwide license by the Central Bank of Kenya (CBK) in June 2015 becoming the twelfth microfinance bank in Kenya.

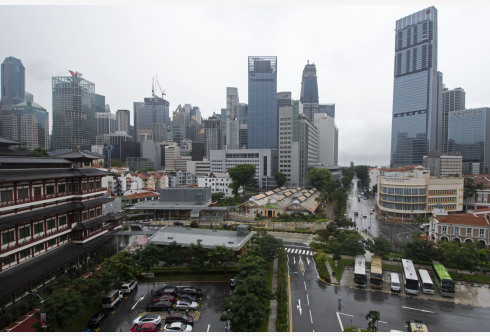

Mr Mukaru indicated that the financial institution’s entry into Nakuru considered the reality that the county has been established as a sustainable and vibrant business destination.

He was speaking after Deputy Governor Mr David Kones officially inaugurated the branch. The occasion was also graced by Nakuru Catholic Diocese Bishop Reverend Cleophas Oseso and Caritas Microfinance Bank Chairman Mr Patrick Kinyori.

The CEO disclosed that the bank’s main objective is to promote human development through the provision of affordable financial products.

“To have a national outreach, the MFB is adopting a social and competitive pricing approach and a two-pronged distribution strategy; branches and marketing offices.

“The MFB is also employing the wholistic approach towards improving its members’ economic and social status,” added Mr Mukaru.

As its core clients, the MFB, Mr Mukaru added, was targeting micro and small enterprises, specifically church-based groups, farmers, self-help groups, agribusinesses, individuals and disadvantaged groups, including slum dwellers, single mothers, people living with disabilities, youth and women groups.

“We are intentional about supporting the realization of Vision 2030 – transforming Kenya into a newly industrialized, middle-income country, providing a high quality of life to all its citizens in a clean and secure environment,” he said.

He also noted that the passing of data protection regulations in the country would place confidence on clients, since rogue players in the industry would be eliminated, as legitimate ones are left to deliver.

The financial institution noted that in Nakuru, which was ranked among the top five biggest contributors to Kenya’s GDP, there is a credit gap that needs to be filled.

“It pleases us to collaborate this position by enabling emerging businesses and entrepreneurs realize their aspirations and expand their possibilities through improved access to finances,” Mr Mukaru stated.

The lender offers facilities such as insurance premium financing and a self-service revolving credit limit facility. Part of the institution's strategy is supporting businesses that are yet to recover from the effects of Covid-19.

Mr Kones observed that Small and Medium Enterprises in Kenya continue to face significant challenges in accessing credit. He added that financial institutions are often constrained by regulatory requirements and limited appetite for a segment that is perceived to be higher risk.

According to an International Monetary Fund (IMF) report, Financial Access Survey, use of digital finance is expanding, but small and medium enterprises (SMEs) and women have less access to it.

The Financial Access Survey: 2022 Trends and Developments, paints a picture of the financial access and inclusion trends post-Covid-19 pandemic, and how SMEs have been affected. Several research projects have confirmed that poor or low access to finance is usually among the reasons why start-ups fail. The IMF survey found that women entrepreneurs continue to be disadvantaged.

“Data for SMEs and women reveal that challenges remain in terms of financial access of these vulnerable groups,” the report states. The study also discusses the continued expansion in the use of digital financial services during 2021, which is considerably higher than the pre-pandemic levels.

The Deputy Governor indicated that SMEs account for a large share of employment and output, yet they tend to face greater constraints in accessing finance.

Mr Kones noted that small businesses form over 90 per cent of businesses in the economy and whose performance has a big positive impact on the country’s economic growth.

Curing the small businesses’ old disease of being denied the much-needed finance for operations and expansion, he said will boost economic growth, which will yield more jobs and revenue for the government since the businesses are the bedrock of the economy.

He said affordable credit facilities will further address the challenge of many small businesses collapsing after a short while.

Bishop Oseso said the micro lender will leverage on the massive church membership network to drive growth besides roping in additional customers seeking affordable credit facilities.

Courtesy; K.N.A

What's Your Reaction?