John Mbadi: Government intends to reduce VAT from 16 to 14 percent

By Peter Ochieng

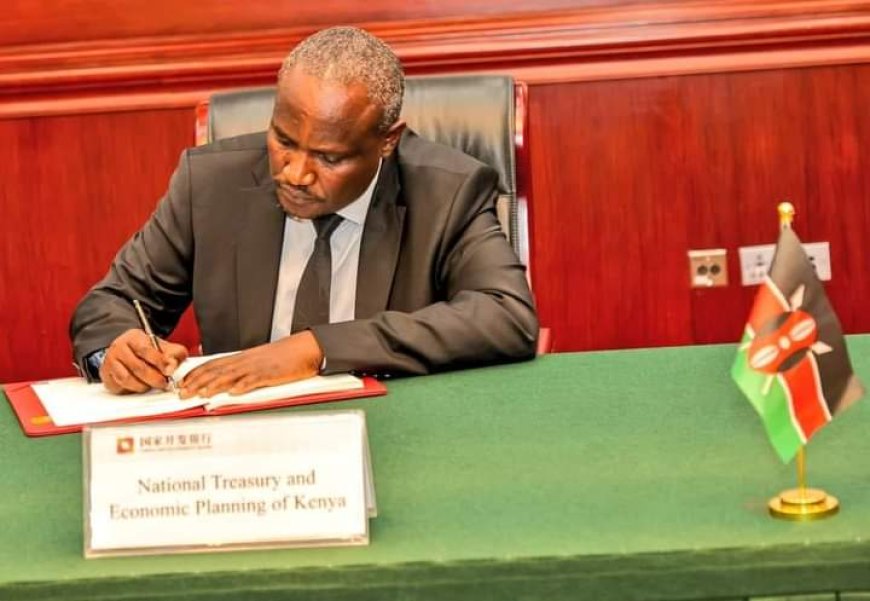

Plans are in top gear to reduce Value Added Tax (VAT) on products and services, and other taxes, Treasury Cabinet Secretary (CS) John Mbadi has disclosed.

Speaking during the launch of the Financial Year (FY) 2025/26 budget preparation process, Mbadi said there is motivation to reduce VAT from the current 16 to 14 percent.

He said the move will go in tandem with reduction of corporate tax and other taxes, in a bid to reduce economic pressure on Kenyans overburdened by the high cost of living.

Agriculture, Mbadi said, has been identified as a sector to help spur the country's economic growth.

“Agriculture will be prioritized to support manufacturing and economic growth, with a focus on SMEs and housing. Despite operating under fiscal constraints, the government will work to ensure growth and broaden opportunities,” Mbadi stated.

“However, it is important to note that following the withdrawal of the 2024 Finance Bill, the Government has had to forego additional revenue measures. We therefore implemented measures aimed at aligning our priorities with the available resources,” added the former ODM national chairman, in relation to the withdrawn Finance Bill, 2024.

President William Ruto unconditionally withdrew the Bill in June, at the height of protests organised by millennials and Gen-Zs.

Consequently, Mbadi said, the Kenya Kwanza administration will not support any additional expenditures, but instead focus on enhancing efficiency, accountability, and prudent use of resources.

He added that plans are underway to implement a new financial management system, with an emphasis on transparency in the procurement process.

The event was attended by among others, Treasury PS Chris Kiptoo.

What's Your Reaction?