CBK launches Kenya’s Quick Response (QR) code standards

Nairobi, Thursday, May 4, 2023

KNA by Emma Wambui

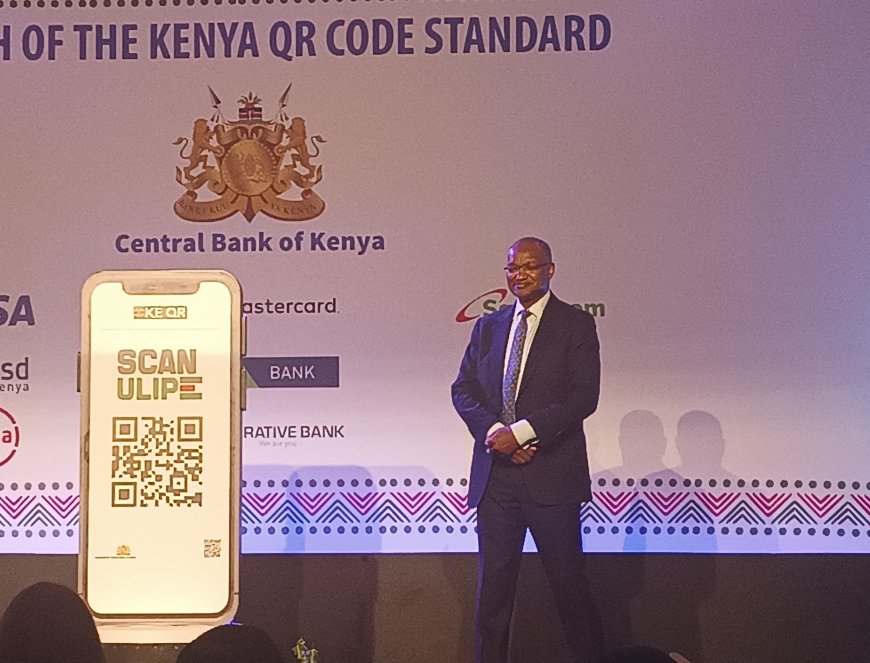

Central Bank of Kenya (CBK) has launched the issuance and implementation of the Kenya Quick Response (QR) Code Standard 2023.

The standard will guide how payments service providers and banks that are regulated offer practical benefits to businesses and customers as they will now be able to make digital payments in an easy, fast, convenient and secure manner using QR.

CBK Governor, Dr. Patrick Njoroge said that the QR code adds to the Kenya digital payment infrastructure and is expected to enhance the experience of a regional payment system.

“The payment system will provide Kenyans with additional secure payment solution methods increasing usability and consumer adoption of digital payment channels,” he said.

In addition, he stated that the QR code will offer customers an advantage by simplifying the process of initiating and making payment transactions

“The use of QR code is expected to increase the safety and security of Kenyan transactions by direct data capture,” said Dr. Njoroge.

He added that the use of QR code will unify payment modes across the entire industry so that customers do not have to go through the process of keying in different merchants' payment numbers any time they make purchases.

The CBK governor who launched the Kenya Quick Recovery Code Standard Wednesday at Safari park hotel said that this move was an outcome of a collaborative process that brought together the regional payment industries, banks, Kenya service providers, global partners and the Central Bank of Kenya.

“To me this is a milestone and more so one that I respect,” Dr. Njoroge said.

Dr. Njoroge said that the beauty of a successful adoption of the QR code is characterized by simplicity, convenience and security of making digital payments.

The launch was also attended by various sectors in Telecommunications, Banking and leading financial schemes who were the main players at the event.

Courtesy; K.N.A

What's Your Reaction?