Government borrowing to be pegged on repayment power

Isiolo, Sunday, May 7, 2023

KNA by David Nduro

The government is destined to change the country’s debt limit in a proposal to peg it on a 55 percent ratio of the Gross Domestic Product (GDP) so as to have a relaxed repayment capacity.

Under the new financial law proposals, the treasury seeks to have an amendment on debt/borrowing so that it can be secured on the country’s GDP ability.

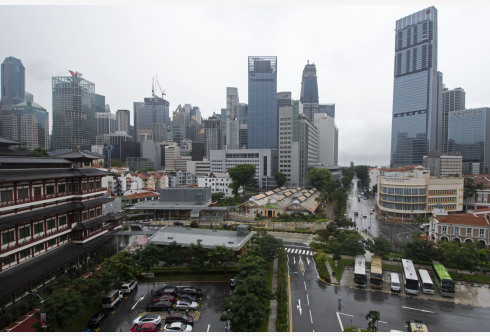

During a public participation exercise for Meru, Isiolo, Marsabit and Samburu Counties held in Isiolo town, the chairman of the National task force of Public Finance Management Act 2012 Amendment who is also the head of resource mobilisation Department at the National Treasury Michael Mwangi Kahiti said the changes will ease payment of public debts regardless of the state of the GDP.

Mr Kahiti said the meeting was to sensitise the public on the existing regulations guiding the debts and borrowing by the government as well as how the changes will enhance transparency and accountability in the public finance management lessening the economy from frustrations in budget management

The country’s debt ceiling is currently Sh 10 trillion that was set by the Parliament and the budget deficit that leads to borrowing, may prove difficult due to GDP performance which sometimes fluctuates following drought and failure of the Kenya Revenue Authority (KRA) failing to meet targets.

Mr Kahiti said the Sh 10 trillion limit is not anchored on the country’s ability to pay debts and therefore there is a great need to have an amendment proposing a rate of debt that the economy can sustain.

“The country’s debt limit should be anchored on the country’s debt carrying capacity and the debt risk classifications based on current best practices used globally. This will enhance transparency and accountability in public finance management in line with the Constitution of Kenya,’ the economist added.

He said the proposed amendment will allow the Cabinet Secretary for the National Treasury to be appearing in Parliament whenever the threshold for borrowing exceeded and explaining the causes of surpassing the limit, the measures and the timelines put in place to remedy the situation.

Majority of the participants agreed to have the borrowing pegged on a rate of not more than 55 percent of the GDP but a few preferred a rate not exceeding 61 percent so as to allow the country budget for development functions as well as catering for recurrent expenditure without straining the economy.

Courtesy; K.N.A

What's Your Reaction?