Report reveals low health insurance coverage in the country

By Peter Ochieng

Alice Anyango (not her real name) is a small-scale trader in Kisumu.

Her daily routine entails going to Kibuye market each morning to buy kales (sukuma wiki), tomatoes and onions, which she in turn sells to her customers in Obunga estate.

About two months ago, she was knocked down by a speeding boda boda (motorcycle) rider, as she crossed the busy Kisumu – Kakamega road, from the market. The suspect sped away.

The 36-year-old single mother of three got injured on her right knee. She was rushed to a public hospital.

However, getting treatment was a herculean task as she had no cash and lacked a health insurance cover.

“I was taken to the hospital by well-wishers. However, getting treatment was a challenge as I did not have cash. I also do not have a health insurance cover. No one was willing to serve me. I got treatment in the afternoon, after some of my friends contributed money and came to the hospital,” narrated Anyango.

She says she is not able to pay for a health insurance cover, because of the minimal returns from her business.

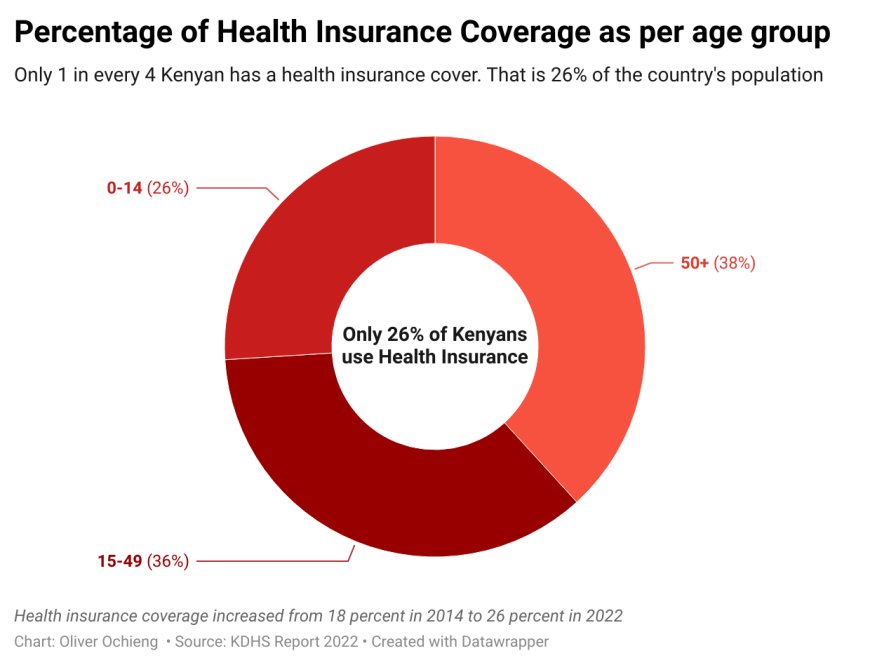

She is not alone, if the Kenya Demographic Health Survey (KDHS) report, 2022 is anything to go by. According to the report, only 1 in every four Kenyans has a health insurance cover.

That is about 26% of Kenya’s over 50 million population. The percentage was 18 in 2014.

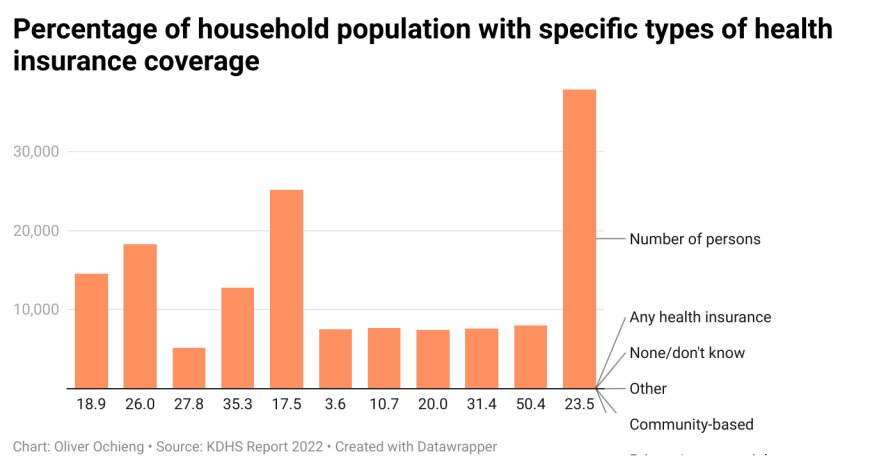

The report adds that 8 out of every 10 Kenyans, that is to say 83% of Kenyans with a health cover are covered by the National Health Insurance Fund (NHIF).

Among those covered by NHIF is Sylvester Oduor, a boda boda rider in Kisumu. Being an individual contributor, he has religiously paid his Sh500 monthly contribution for over 10 years now.

He recalls an incident when the cover came through for him, in a big way.

“Years back while still in Nairobi, I took my wife to Mbagathi hospital to deliver. It turned out that she had to undergo an operation. At the end of the day, the total bill hit Sh65, 000. I never paid a damn cent, NHIF cleared the bill,” he said.

He urges Kenyans, especially those not in formal employment like Anyango to take up NHIF cover.

Oduor says anyone without a health cover definitely depends on out of the pocket payment whenever disease strikes. “That is very risky,” he adds.

Apollo Sport’s NHIF cover is being paid for by his employer. This means his young family of a wife and a daughter is well covered.

He recalls a day when he was admitted in hospital after catching a bout of malaria, where he had to spend two days. He walked away without spending a dime, after NHIF cleared the bill.

Faraji Musa, a Primary School teacher enjoys a private health insurance cover. He pays over Sh1, 000 to the insurer every month, geared towards ensuring that cases of out-of-pocket payment do not come up while seeking medication.

“It is very important to have a health insurance cover because one does not know when disease will strike. You can be sick when you have no money at all. If you have a health insurance cover, you will have nothing to worry about,” he said.

For Amina Faizul (not her real name), paying for NHIF cover as an individual contributor is a struggle.

However, the Mombasa based journalist says she has to, since she understands the risks associated with paying for medication out of pocket. Her media company used to pay for her NHIF cover, but abruptly stopped over ‘tough economic times.’

She wasn’t notified. Six months elapsed without any payment being remitted. One day, her son was taken down by pneumonia and got admitted.

She was shocked to learn that her NHIF card was inactive. Amina was directed to pay Sh7, 500 and wait for three months before the card is termed active.

Add that to the weight of sourcing for funds to clear her son’s medical bill, which stood at Sh20, 000. She managed, and her card is set to become active at the end of this month.

“I am employed but I find it difficult to pay the Sh500 every month,” she says, which points to the fact that most of the self-employed or unemployed, normally struggle to maintain NHIF or any other health cover for that matter.

That is where Cabinet Secretary (CS) Susan Nakhumicha comes in. She says the rates will be reviewed downwards, in a bid to ensure more Kenyans join the national health insurer.

“Soon, two months from now, we are going to reduce NHIF rates from Sh500 to Sh300,” the CS said recently.

However, Dr Onyango Ndong’a, Kenya Medical Practitioners and Dentists Union (KMPDU) Nyanza region chairman does not back the CS on reduction of rates.

Ndong’a says the government should come up with a strategy of ensuring that each person, especially the non-employed, pay for health insurance, according to his or her income.

He says instead of insisting that they pay Sh500 or Sh300 per month, low-income earners can for example be allowed to pay even Sh20.

He said the move will see more Kenyans join the health insurance league.

"Technically it means that 7 out of every 8 Kenyans are one step away from poverty,” he says in reaction to the KDHS report. “Modern and evolving healthcare is very expensive,” he adds.

The KDHS figures can be read alongside the 2021/2022 economic survey report, which states that NHIF membership increased by 6.6 per cent to 23.4 million, from 2020/2021.

In Africa, Rwanda leads the line in health insurance coverage. According to a report published on the United Nation website (www.un.org) in 2017 titled, “It’s time to rethink medical insurance,” Rwanda is Africa’s trailblazer in providing universal health insurance.

Its community based national pan coverage rate is the highest on the continent.

The plan, called mutual health, covers 91% of Rwanda’s 13.7 million population.

What's Your Reaction?